By Minos-Athanasios Karyotakis

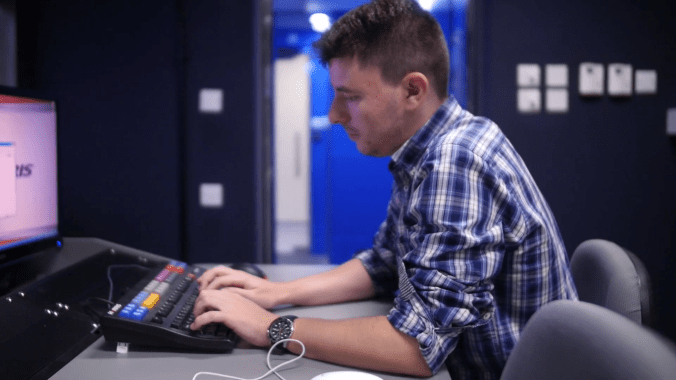

The last few years Greece has attracted the attention of the globe due to its financial difficulties and the unending negotiations of its bailout programmes. The loss of hope and the future that seems to be miserable are some of the reasons why this Mediterranean country is facing one of the most crucial brain drain of its recent history. However, there are still young people in the country that try to cope with the unbearable daily Greek life and realise their dreams. This specific story talks about the struggle of success and the students of the School of Electrical & Computer Engineering of Aristotle University of Thessaloniki that in 2005 decided to take their fate into their hands by creating PANDORA (Program for the Advancement of Non Directed Operating Robotic Agents). Nowadays, their inventions have competed in the RoboCup Rescue competition four times and hold a second place in autonomy category in 2013 in Eindhoven, Netherlands. Continue reading →